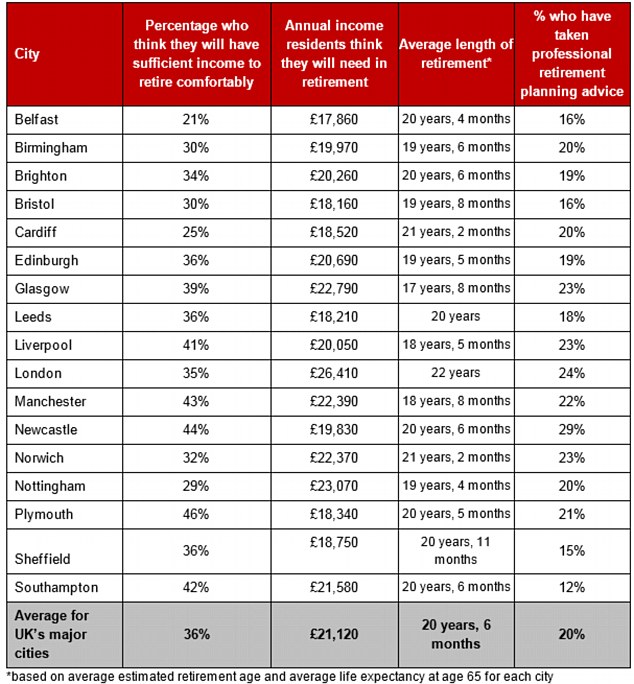

Workers in the UK’s biggest cities are pessimistic about retiring on £21k per year; a new survey by Prudential has shown.

Taken as an average only 36% believe they will have a comfortable retirement and those surveyed on average believe a figure of £21,120 per year will be needed to achieve a good retirement. Londoners believe that £26,000 a year will be needed.

An earlier survey conducted by Prudential showed that many believed that their income would just be £18,100 on average. In 2008, just before the financial bailout the average retirement income was £18,700 per year, in 2013 it hit a low of £15,300.

In their latest poll, 2,200 workers aged 18 plus were surveyed in the UK’s seventeen biggest cities with 50% of respondents aged 55 plus. The idea being that they would be better able to predict living expenses in retirement.

What Factors Affect my Retirement Income?

Aspects which have affected pension incomes are the decline in the ‘gold standard’ pension which is two thirds of pre-retirement income, inflation protection, and a provision for a spouse after death. The final salary pension is dwindling and has almost been phased out.

Most pensions are defined contribution based and rely on investing in the stock market for a good return and as such carry risk. Since their introduction, many have opted for income drawdown schemes which give you more control over your pension as you can withdraw lump sums from it. It does carry risks which are complex to understand.

To get a good handle on pensions it is good practice to talk to a financial planner.

Making Sense of your Pension

If you want clarity about your pensions and indeed get a good idea on your future retirement income, then talking financial advice is in your best interest. Click here and complete the CALL BACK SERVICE form and talk to me, an award winning financial planner and get the needed perspective on your pension.

Source: Daily Mail

For more information, please contact Michele Carby at Holborn Asset Management on +971 50 618 6463 and on e-mail at [email protected]