Don’t be Caught out by the Taxman

If you are planning to take full advantage of Pension Freedom it is important you understand the tax implications. Failure to do so could incur crippling tax bills which will severely impact your retirement plans.

How much tax do I pay on each Pension Freedom withdraw?

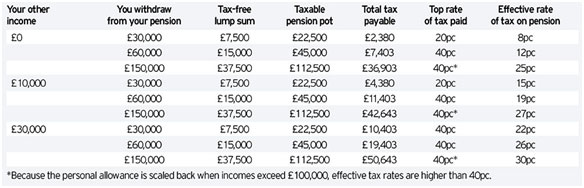

The first 25% of a withdraw will be tax free. The rest is classed as an income and subsequently taxable. Therefore withdrawing your whole pot in one go is not a good plan. As your pension is a taxable income, a sizeable chunk will disappear in tax.

This table gives clarity on the subject:

Factor in your personal allowance

Bear in mind that you can earn up to £10,600 per year tax-free from April 2015 to April 2016 as personal allowance. So say you decided to withdraw £30,000, you will only pay 8% tax on the full amount. This is due to the tax free lump sum and tax free personal allowance.

It is tricks like this that can see you pay far less to the taxman.

Concerns over Pension Freedom

With the capability to draw down money as and when you want has raised concerns in both the financial and political spheres. Mostly, this concerns tax. If you were unaware that your pension was classed as income, you would be shocked to pay out so much of your pension in tax, especially if you had plans for the money. You could also find yourself in serious trouble.

The Government has told pension providers to explain tax to their clients, but the net affect could make little difference in the grand scheme of things. Tax is a complex yet dull issue, and the fear is that most people will remain ignorant of tax in relation to Pension Freedom until it is too late.

Many financial professionals like Jonathan Watts-Lay believe most people will pay more than they expected in tax. He said:

“It’s important to utilise your available tax allowances and reliefs in a structured manor to maximise returns and reduce, or even eliminate, a potential tax charge.”

Factor in all of your incomes

It is important that you factor in all of your incomes. Again, you could be hit with another nasty tax bill if you do not. The other factor to remember is that should you go over tax thresholds you will pay more tax accordingly.

Contact me for tax advice

Tax will no doubt dog Pension Freedom and the unwary will be hit hard. Do not be one of them, click here and complete the Call Back Service Form. Together we can discuss your retirement plans and formulate a way to reduce your tax bill as much as possible.

Source:

The Daily Telegraph

For more information, please contact Michele Carby at Holborn Asset Management on +971 50 618 6463 and on e-mail at [email protected]